Bachelor of Commerce

Career Opportunities

This program is not currently accepting applications.

The Bachelor of Commerce degree provides you with the business and management skills necessary to become an effective manager and leader in a dynamic and global economy. The program blends a practical management education with a broad general education.

Specialize in a business discipline or pursue a general management degree. To ready yourself for a professional designation after graduation, choose from several concentrations: accounting, finance, general management, human resources, leadership, marketing or technology.

Laddering

Graduates of this program meet the entrance requirements for the Master of Business Administration.

Fit your life around school

Admission requirements

Normally, formal admission requires completion of a minimum of 60 applicable credits or a suitable two-year business diploma program. Applicants who do not meet this requirement but possess other post-secondary credits and/or significant experiential learning may also apply and may receive credit for courses taken and/or through Prior Learning Assessment and Recognition (PLAR). Those assessed as lacking some requirements may be admitted to the degree program provisionally (pending completion of qualifying coursework).

Residency requirements

A minimum of 15 TRU credits (distance or on-campus)

Degree requirements

At least 120 credits, including 45 upper-level credits, with a GPA of 2.00 or higher for all breadth and core knowledge courses required to complete this credential, as follows:

Breadth requirements (18 credits)

- Three credits in English

- Six credits in humanities or social science

- Three credits in natural sciences

- Six credits in arts and science electives

Core knowledge requirements (54 credits)

- ACCT 1221, Accounting 2 (3) or ACCT 2211, Financial Accounting

- ACCT 2251, Management Accounting (3)

- ORGB 2811, Organizational Behaviour (3)

- MNGT 3711, Business Ethics and Society (3)

- FNCE 2121, Financial Management (3)

- MKTG 2431, Marketing (3)

- MNGT 4711, Decision Analysis (3) or ACCT 4251, Advanced Management Accounting (3)

- HRMN 2821, Human Resource Management (3) or HRMN 3841, Employee and Labour Relations (3) or BBUS 3661, Strategic Human Resource Management (3)

- BLAW 2911, Commercial Law (3)

- MNGT 4781, Strategic Management (3)

- MIST 2611, Management Information Systems (3)

- ECON 1901, Principles of Microeconomics (3)

- ECON 1951, Principles of Macroeconomics (3)

- MATH 1071, Fundamentals of Mathematics for Business and Economics (3) or MATH 1091, Business Mathematics (3) or MATH 1101, Finite Mathematics (3)

- MNGT 1211, Management Principles and Practices (3)

- STAT 1201, Introduction to Probability and Statistics (3)

Two of the following:

- CMNS 1291, Introduction to Professional Writing (3)

- CMNS 1811, Professional and Academic Composition (3)

- BBUS 3631, Open Communication: Effective Communication Skills (3)

You cannot receive credit for both CMNS 1291 and CMNS 1811.

Elective requirements (33 credits)

Academic and/or applied credits to bring the total number of credits to 120

Concentration requirements (15 credits)

15 credits in one of the following concentrations, with a GPA of 2.33 (a grade of C+) or higher in each concentration course, as follows:

Accounting Concentration

This concentration prepares you to become an integral part of an organization’s financial management team or to enter public practice as an auditor, tax specialist or consultant. Government, non-profit organizations, major corporations, small businesses and high-worth individuals all need accountants to manage their financial affairs. Upon graduation, most students choose to pursue the Chartered Professional Accountant (CPA) designation.

- ACCT 3201, Intermediate Financial Accounting 1 (3)

- ACCT 3211, Intermediate Financial Accounting 2 (3)

- ACCT 3221, Income Taxation 1 (3)

- ACCT 3251, Intermediate Management Accounting (3)

One of the following:

Finance Concentration

This concentration is a demanding program that prepares you to play an important role in the financial industry. The profession is divided into two main fields: managerial finance and investments.

Investments deal with managing savings in the economy by transferring them to individuals and corporations in need of capital in exchange for an appropriate return. Professionals spend their time designing, pricing, and trading investment instruments such as term deposits, personal loans, stocks, bonds and asset-backed securities to aid in the flow of funds. Some of our economy's biggest corporations, including banks, mutual fund companies, private equity firms and insurance companies, serve as intermediaries in this process.

In managerial finance, professionals arrange required financing for an organization's daily operations and future growth. Sources of capital such as lines of credit, corporate paper, term loans, mortgages, bonds, leases, venture capital and IPOs are used to finance seasonal build-ups in working capital and major asset purchases. In doing this, financial managers are careful not to expose the organization to unacceptable levels of risk by over borrowing or leaving exposures to currency or interest rate fluctuations unhedged.

Upon graduation, an increasing number of students go on to complete a professional designations such as the Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), or one of the many financial training programs offered by the Canadian Securities Institute.

- FNCE 3151, Investments 1 (3)

- FNCE 3171, Investments 2 (3)

- FNCE 3180, Risk Management and Financial Engineering (3) (TRU on-campus) or FNCE 403, Risk Management (3) (Athabasca)

Two of the following:

One of:

- FNCE 4130, Advanced Financial Management (3) (TRU on-campus)

- ADMN 3117, Financial Management II (3) (Nipissing University)

One of:

- FNCE 4160, Portfolio Management (3) (TRU on-campus course)

- FNCE 470, Portfolio Management (3) (Athabasca University)

One of:

- FNCE 4180, International Financial Management (3) (TRU on-campus)

- ECON 3127, International Financial Management (3) (Nipissing University)

One of:

- FNCE 4190, Financial Institutions Management (3) (TRU on-campus)

- ADMN 2116, Management of Financial Institutions (3) (Nipissing University)

General Management Concentration

This concentration is designed for you if you do not want to specialize in a specific area of business but would like to take an array of courses instead to receive greater breadth in your management education or if you want to focus on a specialized field of your own choosing. Many positions in business require the varied skills that a generalist can offer.

Approved 3000- and/or 4000-level courses (normally ACCT, BLAW, BUSN, ENTR, FNCE, HRMN, IBUS, MIST, MKTG, MNGT, ORGB and SCMN), with a minimum of six credits at the 4000 level

Human Resources Concentration

This concentration prepares you to pursue the Certified Human Resource Professional (CHRP) designation, which is increasingly becoming a requirement for advancement in the field. Human resources management professionals are the employee relations specialists who manage employee planning, recruitment, selection, compensation, training and development, health and safety and evaluation. They are also active in labour relations, taking the lead in union contract negotiations, grievance handling, including mediation and arbitration, and all other employee-related matters, such as wrongful dismissal, personal harassment and privacy.

- BBUS 4135, Motivation and Productivity (3)

6 credits from the following:

- ORGB 4871, Organizational Development and Change (3)

- MNGT 4751, Project Management (6)

- BBUS 4833, Effective Leadership (3)

Two of the following:

Leadership Concentration

This concentration focuses on development of the knowledge and skills necessary to be an effective leader in today's dynamic work environment.

Required courses:

- MNGT 3731, Leadership (3)

- BBUS 3671, Contemporary Leadership (3)

- BBUS 4833, Effective Leadership (3)

Six credits from the following:

Marketing Concentration

This concentration prepares you to assume one of the most important roles in business. Marketers are a company's creative force, focusing on the marketing mix also known as the four "Ps": product, price, promotion and place. They devise potentially profitable new product ideas that meet the needs of specific target markets and then develop and execute the detailed plans needed for their implementation. Other employees in accounting, finance or human resource management simply assist marketing professionals in this primary task and depend on them to generate the revenues required for a company's survival.

MKTG 3481, Marketing Research (3)

Four of the following:

- MKTG 3451, Professional Selling (3)

- MKTG 3471, Consumer Behaviour (3)

- IBUS 3511, International Business (3)

- MKTG 4411, Services Marketing (3)

- MKTG 4431, Retail Marketing (3)

- MKTG 4471, International Marketing (3)

- MKTG 4481, Integrated Marketing Communication (3)

- MKTG 4491, Business-to-Business Marketing (3)

Technology Concentration

This concentration is intended for you if you have previously completed a technology-related diploma. Courses in the concentration normally consist of credits completed in technology prior to admission. Upon graduation, students are well prepared for management positions in the information technology industry.

- MNGT 4751, Project Management (6)

- 9 credits from a technology area

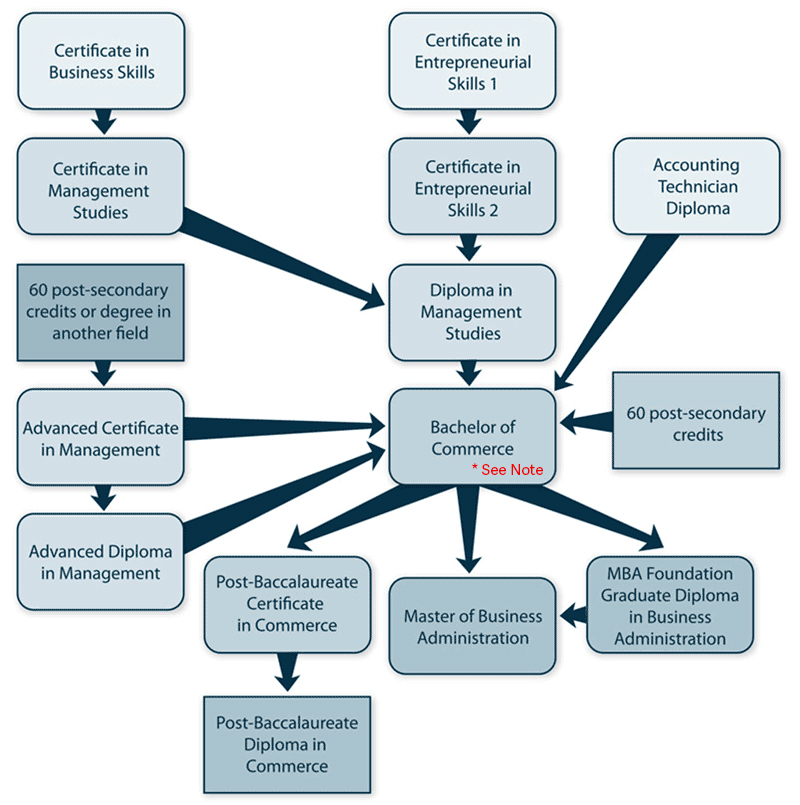

Programs and Pathways

This chart shows how credits gained in one credential can count toward another:

NOTE: The Bachelor of Commerce program is currently not accepting applications