Full-time Assistance

Seven key steps for student grants & loans for distance courses

- Read the information in the section below about full-time government student loans & grants carefully. The more rigid student loan requirements mean much of the normal flexibility of Open Learning's delivery is not available. Make sure that the loss of this flexibility in self-paced study will work for you - including both limited start times and much more limited course durations.

- Become admitted to a designated certificate, diploma or degree (search this list to confirm your program is eligible for funding). Only students who are enrolled* in a designated credential can apply for government student grants and loans.

- *Students who are enrolled in a designated program at a different designated university and intend to transfer TRU credit back to satisfy graduation requirements in that program can be approved for student loan funding through TRU (without being admitted to a TRU program) once they provide to olfinaid@tru.ca their Letter of Permission (LoP) from that institution with the approved courses listed.

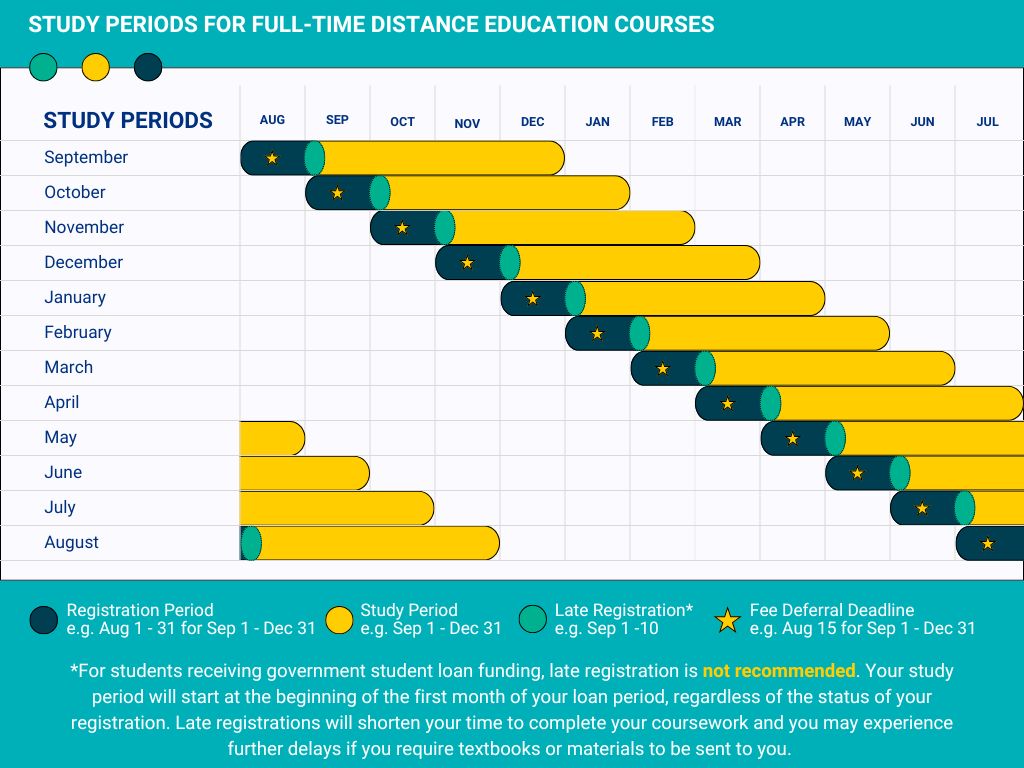

- Select your study period from one of 12 possible terms (See Study Periods below).

- Apply to StudentAidBC if you are a BC resident (or determine your province of residence). Keep a copy of your application number and your pass code.

- Register with Open Learning by the registration deadline:

- Online, with a credit card

- By phone, with a credit card, at 1-800-663-9711 (toll-free in Canada)

- By completing a Fee Deferral Application for Full-Time Distance Education Programs*

- Complete the Study Contract for Full-Time Distance Education Programs*

*Log in with your TRU username and password to access these forms. - Wait two to four weeks after submitting your application to receive notice of your funding.

Distance education study periods for student loans & grants

The registration period for each study period above is up to 30 days prior to the start date for continuous entry courses. For example, register between August 1 to 31 for a September start. Registering as early as possible is recommended, as late registrations mean there is less time to complete and submit work. (Please note that for paced courses with a fixed start date, it is the course's fixed start date that determines which study period it qualifies for.)

The deadline for all fee deferral applications is the 15th of the month prior to the start date (or the last business day prior to the 15th).

How to check your application status

Have your social insurance number and application number handy.

Online at StudentAidBC.

From Vancouver, phone 604-660-2610

From Victoria, phone 250-387-6100

From elsewhere in BC, phone 1-800-561-1818

Contact Student Awards & Financial Aid at 1-800-663-9711 Ext. 4 (toll-free in Canada) if you have questions about using student loans at Open Learning or have general questions about financial aid.

Full-time Government Student Loans & Grants

StudentAid BC and similar programs in other provinces provide Canada Student Loans & Grants and Provincial Student Loans & Grants all through a single application to students who demonstrate financial need and who are enrolled full-time in post-secondary programs.

In BC and many other provinces, the maximum award for both educational and living costs is $320 per week for eligible students without dependents and $510 per week for eligible students with dependents.

To be considered a full-time student in the program, it is necessary to register in and complete a minimum course load of nine new credits per four-month (17 weeks) loan period. (Repeat registrations can be used only when no assignments were passed in the previous registration.)

For distance education students, this is a much shorter completion schedule than the 30 weeks that Open Learning most commonly allows. This can be a challenge for students unfamiliar with studying online and it is recommended that new Open Learning students begin with part-time study or that they familiarize themselves with the new method of study before taking out loans. Information about taking distance courses is provided on this website to help students start and continue successfully as distance learners.

Student loan requirements limit much of the normal flexibility of Open Learning courses.

Unlike self funded courses, you cannot begin courses whenever you want. There are 12 fixed distance education loan periods, each four months long, which start the first of each month. Students are required to register in a full-time course load within the month prior to the start date of each period (e.g., register in August for the September to December term). Late phone and web registrations are permitted up to the 10th day of each month after the term start date using a credit card.

Any continuous-entry registrations received after the final deadline on the 10th day of the month can only be applied to the following term (e.g., a January 11 registration can be applied only to the February loan term).

All students receiving student loans or grants are required to sign a Study Contract.

After registration, full-time status for distance courses is maintained by submitting assignments each month and submitting all coursework during the loan period in nine credits (the minimum required for full-time status). Loan documents and grants are not released past the study period midpoint without sufficient academic progress.

Final examinations may be written within the first two weeks of the month following the loan period (e.g., examinations may be written up to May 14th for a January to April loan).

Failure to submit assignments on a regular schedule throughout the loan period or failure to submit all coursework by the end of the loan period, may be regarded as a "technical" withdrawal from full-time study by government, even though a student does not formally withdraw and TRU still shows a student as enrolled.

This may result in a portion of the loan being placed in "over award" and becoming immediately repayable ("over award" portions of a grant are retroactively converted to an interest-bearing loan).

Eligibility for further funds, payment-free status and other privileges associated with full-time status may be affected.

Payment-free status

Students enrolled in full-time studies who are not negotiating a new Canada Student Loan or BC Student Loan should contact Student Awards & Financial Aid for information about keeping their existing loans in payment-free status.

Full-time Single Parents Bursary Endowment Fund

Established by the CKNW Orphans' Fund, this endowment provides funding to students in distance courses who are single parents, have received the maximum student loan amount and still have "unmet need." Applicants must be returning students and have successfully completed their last full-time term through TRU.

Speak with a Student Awards Advisor regarding completing an online Special Bursary Application through your myTRU account.

Government of Canada's Lifelong Learning Plan (LLP)

Canadian residents and/or their spouses can withdraw up to $10,000 per year from their Registered Retirement Savings Plan (RRSP) to finance full-time studies at post-secondary institutions including Open Learning.

» Canada Revenue Agency.

Other sources of assistance

There are other private bursaries and scholarships available to students attending BC's post-secondary institutions; most of these are available to students registered in Open Learning courses. Application procedures for these awards vary, and most have restrictions and conditions imposed on them. Examples: ScholarshipsCanada, yconic and Universities Canada.